In this article, we are going to discuss 10 Excellent Online Payment Systems.

Online payment systems come in use if you are making money online or thinking to make money online. You will require safe, reliable and user-friendly payment solutions for online transactions.

Now, we are going to review 10 excellent online payment systems for accepting online payments. Some of those have been available to online merchants from very long time and many of them are getting into new areas such as in-store online card reader and social commerce.

Check out this article:

Top 5 Best Payment Gateways For International Transactions.

10 Excellent Online Payment Systems

Before moving into our actual topic, let get familiar with some terms related to an online payment system.

Automated Clearing House (ACH) payments

They are electronic debit and credit transfers that allows customers to make online payments from their bank account. Most of the payment processor offers ACH payments especially for a subscription-based and monthly transaction and is used to send money (minus fees) to customers.

Payment gateway

A payment gateway allows merchants to pass credit card information between him and customer securely. It acts as a middle man between merchants and their sponsoring bank.

Merchant account

A merchant account is a bank account through which customer receive their payments through debit or credit cards. Many online processors contain both payment gateway and merchant account.

Payment processor

The payment processor provides anti-fraud measures to handle credit card transactions. It ensures security to both the merchants and front-facing customers.

1. PayPal

PayPal is the world's most used payment acquirer with 305M active users. Its growth rate is very high and gained 9.3 million new users in 2019 alone.

Payments can be done using credit card or user's existing account and money can be sent directly through email.

It is available in 202 countries and the user can withdraw funds in 56 different currencies. Paypal is safe and completely free to use. You are not charged any amount like membership fees, annual maintenance or maintaining balance.

The good news is that your PayPal account can be connected to your bank account and can make a purchase online even if PayPal balance is zero.

Pricing: PayPal doesn't take any fees for setup or monthly fees. It takes 2.9% + $0.30 per transactions.

2. Authorize.Net

It is also one of the widely used payment gateways that have over 300,000 merchants. It has been a go-to method that needs a gateway to accept payments for eCommerce sites.

It provides a secure shopping experience along with verified safety label from the site, simplified PCI compliance, site ordering and custom checkout pages.

Authorize.Net offers support resources if you have any questions including a toll-free, online portal, phone support, eTicket response system and email contact.

Pricing: Authorize.Net takes 2.9% + $0.30 per transactions.

3. Amazon payments

Amazon payments allow to send money via ACH and receive through its API. It is used by some of the popular sites like Kickstarter.

It is super simple to set up with website and customers can pay for goods by logging into their Amazon accounts.

Amazon payments are optimized both for voice search and mobile and allow to access thousands of sites with just one account.

You can easily charge your customers recurring payments and seamlessly offer refunds.

Pricing: Amazon payments takes 2.9% + $0.30 per transactions.

4.Google Checkout

Checkout is actually Google's answer to PayPal that allows users to make payments through an account connected to their Google profile.

One of the major benefits that Checkout has is, that millions of people use Google for other services and making a purchase through Checkout becomes simpler.

Pricing: Google Checkout takes 2.9% + $0.30 per domestic transactions for sales below $3000 but the percentage can go down depending upon the monthly sales volume.

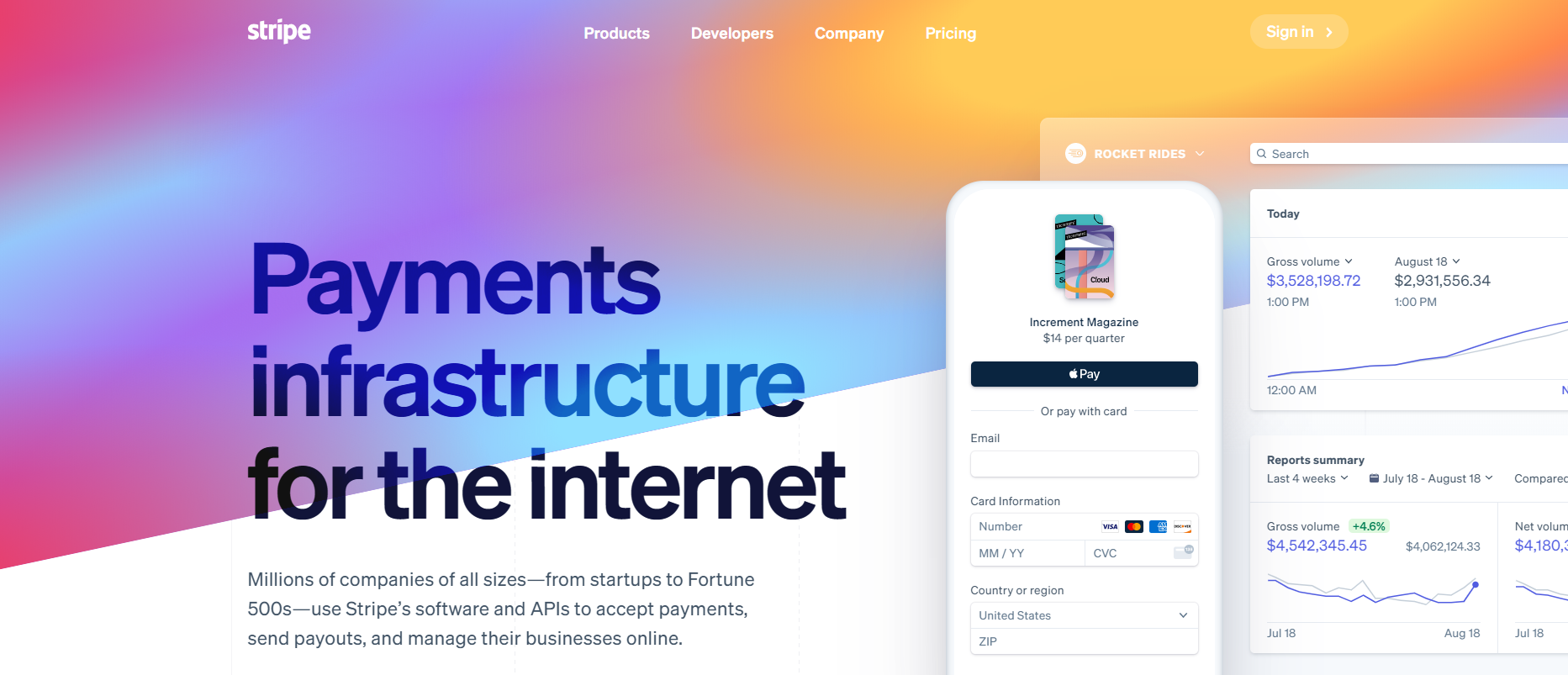

5. Stripe

Web developers can easily integrate payment systems into their project by using Stripe's robust API. So, it is excellent payment solutions for web-developers.

It handles all PCI compliance and merchant approvals by acting merchant account for its providers.

It features one of the best payments for eCommerce site enabling security as well as quick setup. It consists of some mindblowing features like saving card information for one-click checkouts and allowing customers to buy products directly from a tweet.

You can easily view your business analytics using Stripe's Sigma that provides important insights for growth of your business.

Pricing : Stripe takes 2.9% + $0.30 per domestic transactions.

6. Dwolla

Dwolla is PayPal's competitor and one of the newcomers in payment space. Dwolla processes over $1 million per day and set up and payment process is very similar to PayPal.

Dwolla offers same-day and next-day transactions for ACH payments. You can track your search transactions, app activity, view business insights and manage customers using simple API integrations.

Dwolla view security as their DNA and values security through strong cryptography, rigorous monitoring and constant refining.

7. Braintree

It is an online merchant account solution and payment gateway that is known for working with some of the popular tech startups like LivingSocial, Uber and Airbnb. It mainly focuses on mobile users and is owned by Paypal.

Braintree contains special tools for detecting fraud and can be easily integrated with Google Pay, Apple Pay, Venom as well as major debit and credit cards. Being said that Braintree is owned by pay, you may wonder which should I choose? Well, it depends upon the types of business you are running. Go through some points below before deciding between Braintree and Paypal.

• PayPal account can get flagged and deactivated regardless of its easy setup process. Braintree account takes time to set up but provide seamless transactions later.

• Braintree allows sending a large amount of foreign currencies.

8. WePay

WePay allows internet merchants to accept bank accounts payments and credit cards. It mainly focuses on individual users and has recently added e-store pages to help customers conveniently take in payments.

It is designed to handle sophisticated payment requests like crowdfunding campaigns and multiple payers. It is tailored for e-shops with domestic as well as international customers and offers helpful support centre for business using a gateway.

Pricing: WePay takes 3.5% transaction fees along with min $0.50 for credit cards and bank payments.

9. 2Checkout

2Checkout combines payment gateway and merchant account into one. It allows customers to receive PayPal as well as credit card payments. 2Checkout offers recurring billing feature, shopping cart stores as well as international payments.

The good thing about 2Checkout is that it offers demo along with different settings to allow a user to know how the gateway works before using it.

It is available in 15 different languages and allows transactions of 87 currencies. It allows you to directly embed credit card processing to your site.

Pricing: 2Checkout takes 2.9% + $0.30 per domestic transaction.

10. Samurai

Samurai also combines merchant account solution as well as payment gateway. FreeFighter is their main tool that helps to compare rates for merchant accounts.

It was developed as a direct competitor to a gateway and merchant solutions combined such as Braintree and others.

Pricing: Samurai takes 2.3% of sales volume and %0.30 per transactions.

Conclusion

The online payment solutions mentioned above are one of the excellent payment systems as of now. There are numerous online payment systems that can be used to conduct e-commerce activities. You should make a detailed study of your business before selecting online payment solutions for your business.

Readers Comment